The pandemic of COVID-19 in 2020 for many marketers and PR professionals may be the most unprecedented crisis in our careers. Industry by industry, we are seeing dramatic consequences- or overwhelming product sales in certain categories- as the nation wrestles with fear and safety concerns.

For travel/tourism industry professionals, historic moments like this will make or break careers. Never before are actionable, integrated marketing strategies driven by data so critical, particularly in the destination marketing industry. I have watched several webinars from our DMO vendor partners in the past few weeks on the right way to do this, but this Arrivalist webinar struck the right chord (Vimeo Password: ArRiVaLiSt) and I highly recommend it.

Using many those insights as a foundation to build a recovery marketing plan, below are recommendations for destination marketing organization (DMO) marketers to consider as they plan for the future and help pave their city’s economic recovery path forward.

FLEXIBILITY, FLEXIBILITY, FLEXIBILITY

Destinations can induce demand by offering a flexible campaign message that resonates with consumers where they are, and provides significant nimbleness to adjust to markets, personas and demographics as needed. Digital media is the way to go as linear and OOH don’t offer the flexibility you will need to pivot under daily environmental changes. You may find you’ll have to postpone media previously placed in these mediums and won’t be able to adjust markets. This is extremely frustrating, especially if those markets don’t make sense anymore. Digital gives you the flexibility to test new markets and adjust tactics.

By working directly with a digital media team that executes all media campaigns in-house (nothing is outsourced to third parties), DMOs can maximize media spend while relying on expert media buyers for other tactics if needed. If resources allow, buy direct with several media vendors to ensure the most responsible use of appropriated funds. Based on the budgetsize and staff resources of your organization, you might consider PR and owned media efforts to be accomplished in-house with third party PR agency supplemental support to secure further reach.

MEASURING RECOVERY WITH NEW DATA TOOLS

There are three media optimization and ROI research tools I recommend now- Arrivalist, Adara and VisaVue Travel – that can help DMOs not only take action, but can help communicate recovery “success” (of which needs to be discussed internally and externally in advance). Recovery looks different in each market when external factors like stay-at-home orders or your top three target markets becoming hot spots influence your advertising plans.

Arrivalist can be used to plan initial markets, optimize media placements and type and measure actual arrivals by consumers exposed to destination ads. Arrivalist measures customer movement by utilizing a panel of 120 million mobile devices and 4 million connected cars, balanced at the US zip code level. With the ability to measure the holistic impact of media campaigns for hotels, including walk-up traffic, your DMO can measure incremental room nights and ROI from your recovery digital media campaign and understand which tactics performed best while gaining additional insights into guests. Simply put- don’t assume you know who your guest is now. Adara can be used to report hotel booking revenue and hotel search volume affiliated with consumer exposure to campaign ads – which I think is the most important metric under recovery efforts, especially if your organization is funded by hotel tax. VisaVue Travel provides in-market historical spend volume data by DMA.

TIP: When reporting out your Adara results to stakeholders, include three stats: the percent of room inventory tracked by Adara (your rep can tell you this), percent of website traffic being pixeled and a note that Adara works with select booking partners. Adara doesn’t tell you the entire picture and you might not be seeing a significant consumer base. I also do not report on the “enriched” data, but this is a personal choice based on how your stakeholders feel about estimated tourism data.

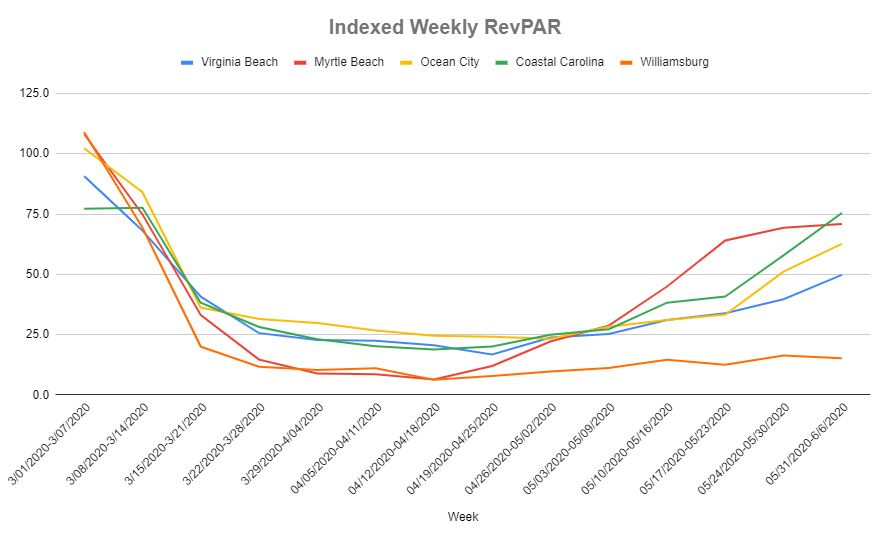

Additionally, your organization will need to monitor weekly (not monthly) RevPAR recovery “speed” (using 2019 data as “Recovery” benchmark) against competitors using Smith Travel Research data as a monitoring metric. This will be a long-term strategic metric to understand how your city fares against competitor destinations in regaining and surpassing historic occupancy and ADR levels.

MARKET PRIORITIZATION

Using existing historical Arrivalist data, your DMO can evaluate and prioritize market opportunities using existing data at our fingertips for relevant insights on market value. Look to answer the following questions using legth of stay, visitation volume and repeat visitation data:

- Who have been our high value visitors? We will look at length of stay.

- What are our high-volume markets? We will look at visitation volume.

- Who are our high loyalty visitors? We will look at repeat visitation data.

- Who are our high spending markets? We will look at Visa credit card expenditure data.

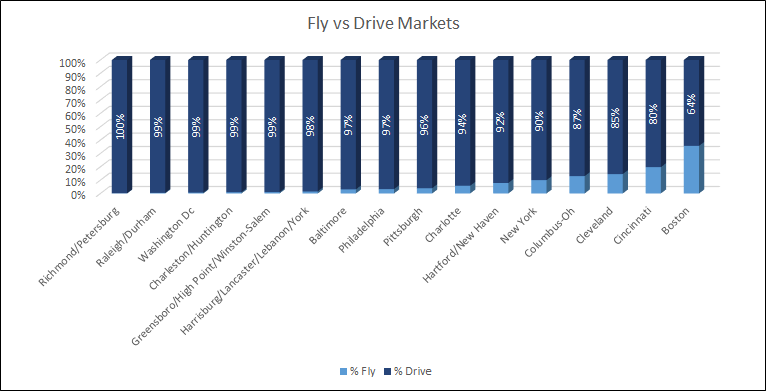

DRIVE VS. AIR MARKETS

In order to understand part market behavior, Arrivalist data also provides DMOs the ability to identify fast-activating markets by looking at days to arrival and easy-access markets through an airport POI assessment. Pay attention to drive markets in the short term and look longer term to convert air markets to drive travelers pending budget. Have the airport geofenced so you can filter non-airport trips from drive trips.

MEDIA OPTIMIZATION

Optimize your media towards fast acting by source and type to get visitors in market as soon as possible for the short term. Look at days to arrival data, which can be sorted by source and media type and viewed by 0-30 days, 0-60 days, 0-90 days, etc. to assess what media needs to be in your plan in the short term.

Looking at these media sources and media types, Arrivalist also provides Arrivals Per Mil and Cost Per Arrival data for efficiency purposes and get the most out of our spend. Share this data with your digital agency and media partners to optimize media and update creative messaging. The priority objective will be to drive more arrivals, followed by repeat visitation and then longer stays. Most effective media may not necessarily be the most cost-effective, so this will have to be a decision made on an ongoing basis.

Media plans should be developed for each market so you can be nimble going forward. Some of these markets you may not activate on simultaneously but will consider a rolling activation. Continue to monitor data, search volume and organic web traffic to uncover “opportunity” markets. Your media flow chart should not be built out more than a few months, and be fluid and nimble with digital placements optimized towards tactics that show greatest return on our objectives.

Media Activation Strategy #1: Staged Messaging

Staged messaging will be critical to the success of this plan. Creative assets should be built out so you can react and adjust along the way, as markets may come on line at different paces. Monitoring the news cycle for any turns in our markets will be critical as the future path of the pandemic (i.e. additional outbreaks) is still unknown. While TV has shown the highest ad recall in the past in my destination, we heavied up investment in banner ads, social and native since those assets can quickly be developed and adjusted at a more cost effective rate.

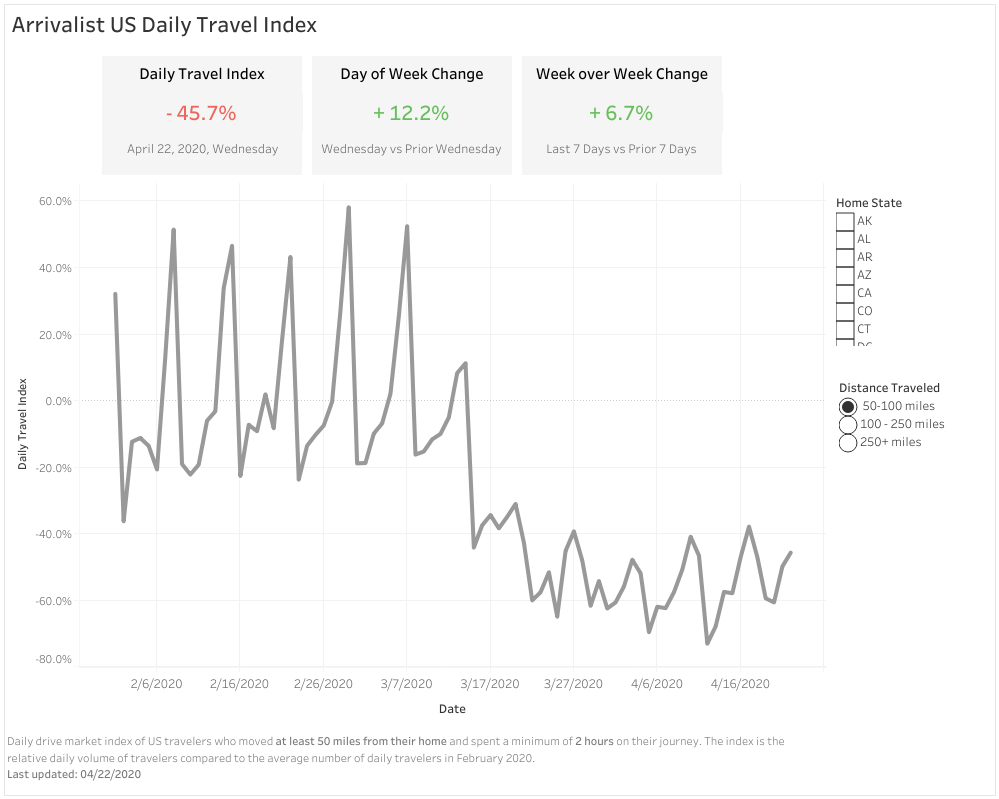

Media Activation Strategy #2: Utilize Daily Travel Index For Each Market to Assess Market Readiness

Arrivalist recently announced a new tool called the Daily Travel Index Report for signs of market readiness, which shows week-over-week consumer road trip mileage bands of 50 miles or more based on consumer cell phone movement. This tool will help marketers gauge fluctuations in drive market trips and indicate when to change messaging from “dreaming” stage to planning to booking.

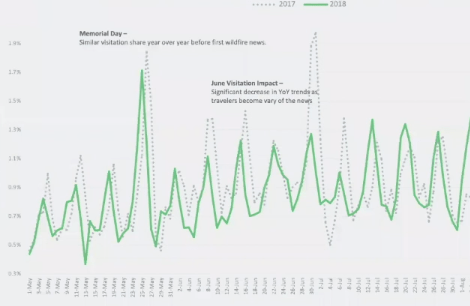

Media Activation Strategy #3: Be Prepared If Future Outbreaks Occur

Situational awareness is necessary at all times. If the Coronavirus breaks out in one of your target markets, prepare empathetic messaging to reflect the mood in advance so you can be respectful to that audience or optimize out of those markets so we are not wasting resources. In my destination, we chose to optimize out for a time period. Be prepared for stakeholder input on these decisions and potential frustrations or mixed reviews. At the end of the day, you are responsible for your brand integrity.

Media Activation Strategy #4: Reach the right audience at the right time using dynamic, personalized content.

You can work with your media vendors to target consumers by age range, gender, household income, behaviors and interests using contextual targeting and persona targeting. Then dynamic content on your website should allows the DMO to serve specific content and messages to the consumer based on their location, interests and whether or not they are a new or returning visitor. You may consider to accentuate unique lifestyle travel pillars that have continued to be part of your destination storytelling brand (outdoors/beaches, history, arts, culinary experiences) during the transition of your city opening back up and use this robust content matrix to inform owned and social channels.

Earned Media

Holding hands with the your paid media strategy is a targeted PR and owned media strategy. Now is the time to assess whether a PR stunt is appropriate given the news cycle and if it will come across irresponsible. Below are some strategic paths for PR during the COVID-19 crisis to consider:

- Segment: Right messages, right audience, right time; Prioritize regional markets & national exposure

- Amplify key differentiators

- Integrate PR into overall marketing efforts; adjust messaging customized to each market in staged approach

- Engage: Aggressive pitching to include a multi-platform approach (digital, print, broadcast) – Trend-spot breaking news, hot topics

Continue to research editorial calendars at key publications to ensure your city is considered for planned feature and round-up stories. Remember that personalized pitches are preferred over releases and get ready for future site visits as journalists look to start travelling again. Be proactive in your outreach as much as you can, but also be prepared that reactive media relations might take priority. Be sure you are staffed for the media volume and consider hiring out a third-party firm for supplemental support.

Key performance indicators for destination-specific PR activity to consider during crisis recovery include share of voice, message penetration and resonance, awareness, preference and consideration. I believe these metrics, as well as increased bookings by target PR markets, to be more valuable right now as travelers are seeking to feel comfortable travelling again and want to feel safe in your market.

Ideas for Stakeholder Reporting

Now more than ever the tourism stakeholders will be looking to the DMO to drive demand and understand the ROI of any funding that has been used for recovery efforts. This is especially true if your DMO has lobbied for additional funds. You may consider sharing hotel searches and hotel booking revenue data secured through Adara Monitor to show the ROI of the recovery campaign. Note that Adara does not secure short term rental data or visiting friends and family. Additionally, Adara pixels may not be able to be placed on all media purchased (i.e. YouTube does not accept media tags). Many communities also have strong cottage industries. Short term rental performance like AirDNA data can be used for reporting for short term rental performance. This data is often of interest when stakeholders want to see hotel-comparable performance data.

You may already be sharing Smith Travel Research occupancy, ADR and RevPAR data with key stakeholders.

Arrivalist data can be used to show the impact on actual arrivals year over year and the impact to recovery. This data allows city leadership, the DMO and stakeholders to view a comprehensive look at the market, measuring all actual arrivals including AirBnB and VRBO in addition to traditional lodging.

Recovery campaigns and stakeholder reporting will vary across DMO based on budget and staff resources. The rate of recovery will vary based on your community status, consumer sentiment and rate fluctuations. I hope these tips and ideas will help you formulate the best plan for you based on actionable data, new tools available to our industry and general best practices.

“Destinations will need to adapt to a new reality concerning how to accommodate visitors when they decide it’s time to start traveling again. Safety will outweigh all other factors including price and geographic proximity. How a destination presents its various tourism products as “safe” to visitors will be the difference between success and failure.

Hotels, restaurants, attractions, event venues, transportation assets and retail will need to collaborate at unparalleled levels to assure consumers that the entire tourism value chain is safe and secure. A coordinated destination approach will be the winning formula.”

-Bill Hanbury, Academy Street Collaboration LLC — March 2020